*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

If you’ve always dreamed of living abroad, now may be the best time. Today, there are around 400,000 American retirees residing outside the United States, with

Introduced in 1989, reverse mortgages were designed for homeowners nearing retirement age. The premise behind a reverse mortgage is to allow those aged 62 or

As a retirement plan, 401(k) plans currently outpace the competition, with more than 54 million Americans participating in a 401(k) plan, and nearly 550,000

As the go-to investment option for most companies and their employees, 401(k) plans provide many benefits to plan participants, including deferment of taxes

While so much of personal finance is common sense – don’t spend more than you make, don’t buy a house you can’t afford, start to invest money while you’re young

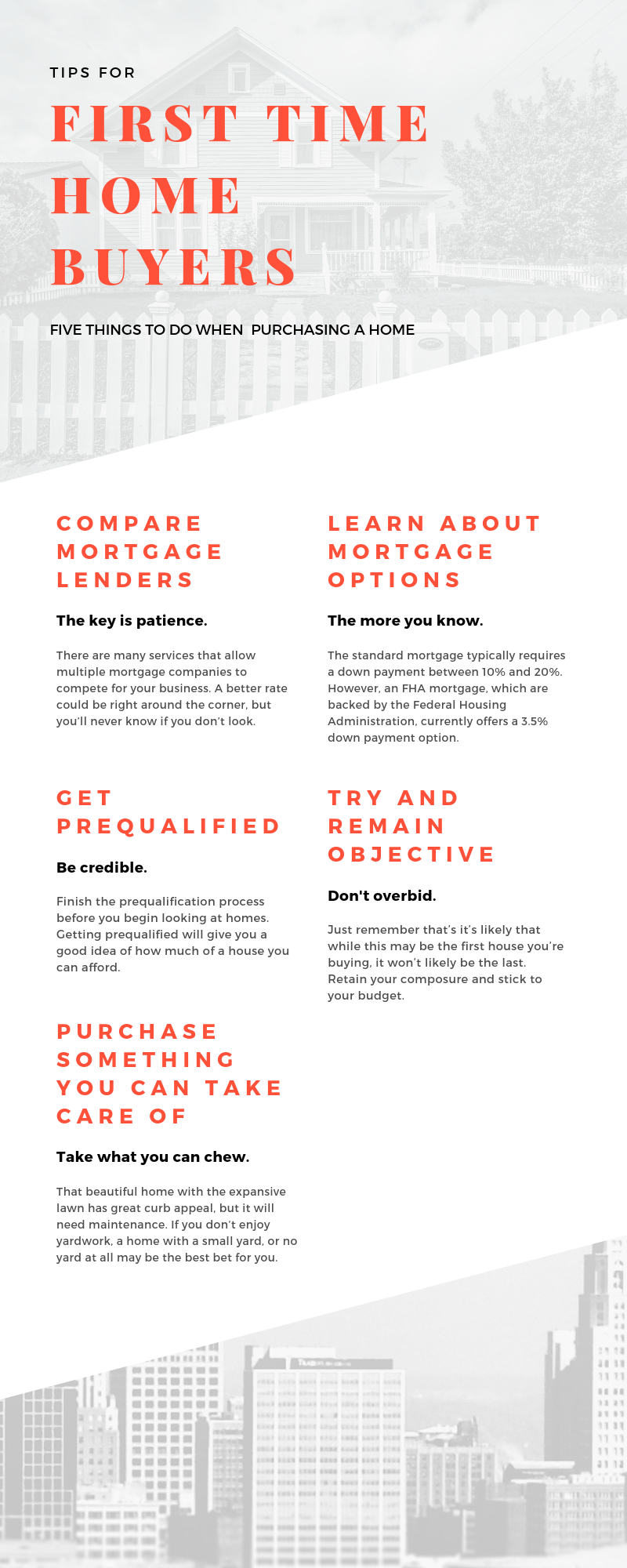

Of all the things you’ll purchase in your lifetime, it’s likely that your home will be the largest, most expensive purchase you will ever make. While homes vary

At the end of the month, do you often find yourself with a lot less money than you expected? Do you have a hard time determining exactly what you spent your

While some of us are spenders, others savers, most of us fall somewhere in between. Can you account for where your cash goes, or do you frequently find

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

While the name may be amusing the reality of zombie debt is anything but funny. Zombie debt is old debt that has been written off years ago, only to be sold to